德邦推出員工持股計劃,資金總額不超過2.2億

Debon launched the ESOP, the total amount of funds does not exceed 220 million

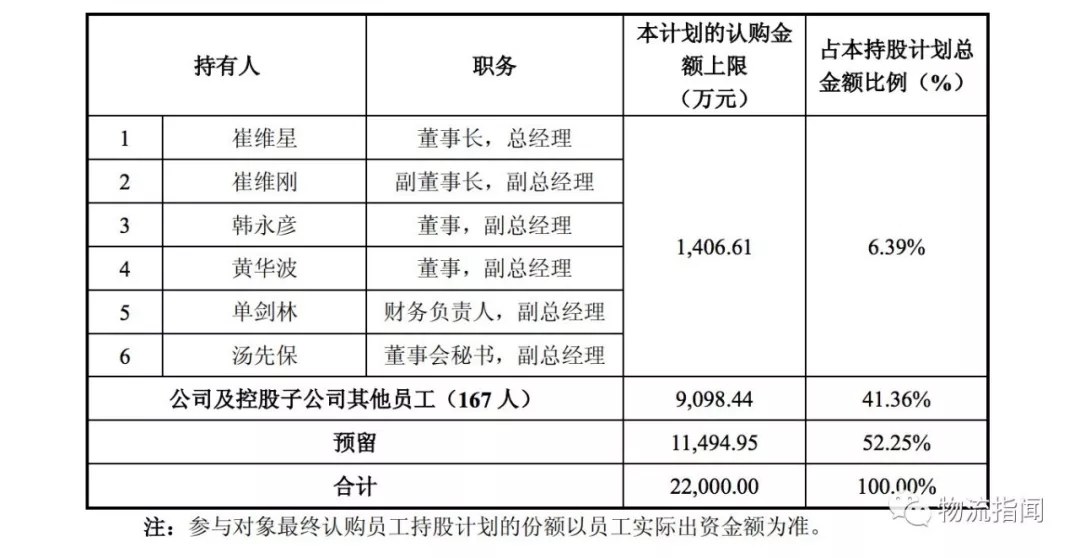

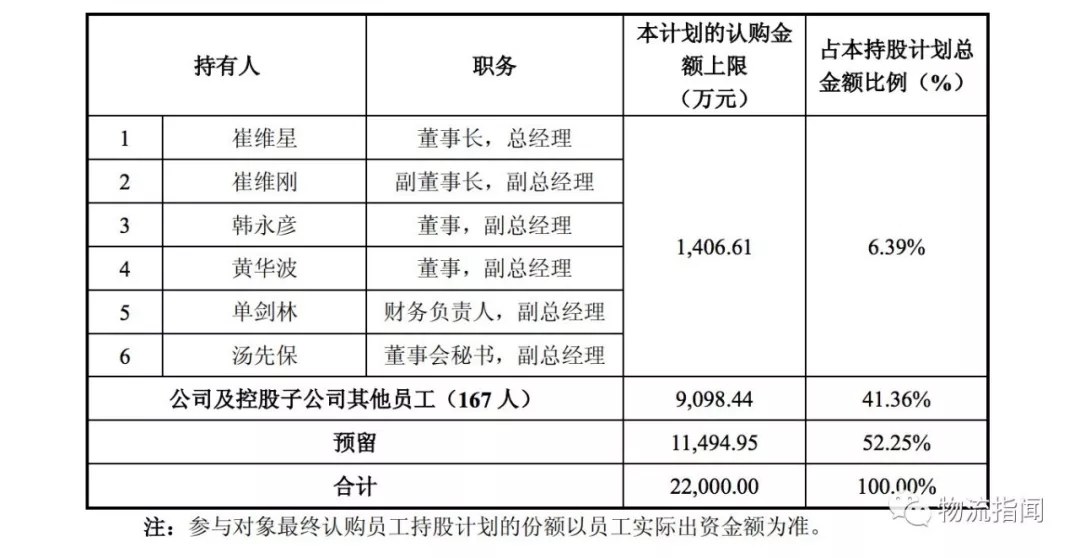

德邦股份9月2日晚發(fā)布員工持股計劃草案。公告顯示����,參加本持股計劃的對象范圍包括公司董監(jiān)高�、公司及控股子公司其他員工等共計不超過2300人,初始設立時持有人總數(shù)為173人(不含預留份額)���,具體參加人數(shù)根據(jù)員工實際繳款情況確定��。

Debon shares issued an employee stock ownership plan draft in the evening of September 2nd. The announcement shows that the scope of participants in the shareholding plan includes no more than 2300 directors and supervisors of the company, other employees of the company and holding subsidiaries, and the total number of holders at the time of initial establishment is 173 (excluding reserved shares). The number of participants is determined according to the actual payment of employees.

據(jù)悉���,本次員工持股計劃設立時資金總額不超過2.2億元,資金來源為公司提取的獎勵基金�、員工自籌資金、控股股東提供的借款等����。持股計劃的股票來源則是通過相關(guān)資產(chǎn)管理計劃二級市場購買德邦股份A股普通股股票。該員工持股計劃存續(xù)期不超過60個月�����。

It is reported that the total amount of funds for the ESOP will not exceed 220 million yuan at the time of its establishment. The funds will come from the incentive funds drawn by the company, the employees'self-financing funds and the loans provided by the controlling shareholders. The stock source of the holding plan is the purchase of A shares of Deutsche Bond common stock through the secondary market of the relevant asset management plan. The ESOP is not extended for more than 60 months.

草案顯示,對于資金來源為員工的自籌資金或控股股東借款等方式的��,其對應標的股票權(quán)益將在公司公告最后一筆標的股票過戶至資管計劃名下的12個月�、24個月以及36個月后,分三期以33%�����、33%����、34%的比例分配至持有人。

According to the draft, the equity of the underlying stock will be distributed to the holder in three phases, 33%, 33% and 34% respectively, 12, 24 and 36 months after the company announces the transfer of the last underlying stock to the name of the management plan.

而對于資金來源為獎勵基金的����,其股票權(quán)益的解禁和分配則將依據(jù)公司2019年至2021年度業(yè)績考核結(jié)果而定。其中�,在公司層面的業(yè)績考核指標有關(guān)凈利潤的要求是,2019年����、2020年、2021年歸屬于上市公司股東的扣非后凈利潤分別不低于4.68 億元����、5.7億元和6.96億元����。若凈利潤等業(yè)績指標達標后�,公司則將于三個解鎖期內(nèi)分別以33%、33%及34%的比例解鎖并分配����。

For the incentive fund, the dissolution and distribution of equity will be based on the company's performance appraisal results from 2019 to 2021. Among them, the net profit requirement of the performance appraisal index at the company level is that the net profit after deduction of shareholders belonging to listed companies in 2019, 2020 and 2021 should be no less than 468 million yuan, 570 million yuan and 696 million yuan, respectively. If the net profit and other performance indicators meet the target, the company will be unlocked and allocated in 33%, 33% and 34% of the three unlocking periods, respectively.

崔維星在內(nèi)部講話中表示,新推出的持股計劃是在原來各項激勵的基礎上新增的�,不會影響原來的計劃���。以前公司長期激勵計劃只覆蓋兩年以上B8和所有B9及以上人員����,這次股權(quán)激勵把B6-7層級也覆蓋進來了���;原來長期激勵計劃在2017年實際只覆蓋了412人����,這次股權(quán)激勵計劃覆蓋將超2000人���,占B6及以上人員比例約為14.0%��。

Cui Weixing said in an internal speech that the new stock ownership plan is based on the original incentives added, will not affect the original plan. Previously, the company's long-term incentive plan covered only B8 and all B9 and above for more than two years, this equity incentive also covered the B6-7 level; the original long-term incentive plan actually covered 412 people in 2017, this equity incentive plan will cover more than 2000 people, accounting for about 14.0% of B6 and above personnel.

崔維星同時指出�,這個激勵規(guī)模遠大于很多同行。以后只要公司業(yè)績好�,股權(quán)激勵計劃會逐年推出,激勵覆蓋范圍還會逐步擴大����。

Cui Weixing also pointed out that this incentive scale is far greater than many peers. In the future, as long as the company's performance is good, the equity incentive plan will be introduced year by year, and the incentive coverage will gradually expand.

轉(zhuǎn)自物流指聞

http://m.caifucehua.cn